Editor’s note — The motivation for writing this story came from a post by Kelly Gilroy on her outstanding Pasco County Development & Growth Updates Facebook page. Former Florida Department of Transportation engineer — and, of course, Neighborhood News correspondent Joel Provenzano agreed that it was worth a deeper dive into what Kelly so perfectly presented. — GN

If you’ve driven around Wesley Chapel lately, you don’t need a traffic study to know one thing: Pasco County is growing fast. New neighborhoods, shopping centers, hospitals and medical offices and industrial parks seem to pop up overnight. With all of that growth comes an obvious question:

Who actually pays for the roads, sidewalks, and transportation infrastructure we all use?

The simple answer, of course, is “all of us,” but one of the biggest pieces of that answer is something called “mobility” (aka “impact”) fees.

What Are Mobility Fees, Anyway?

Mobility fees are one-time charges paid by developers each time a new building permit is issued. These fees help pay for the transportation improvements needed to support new growth, such as:

• New or widened roads

• Turn lanes and intersections

• Sidewalks and bike paths

• Other transportation facilities tied to development

In simple terms: new development helps pay for the new infrastructure it requires — and Pasco County has some of the highest impact fees of any county in Florida.

These fees don’t replace gas taxes or sales taxes, but they work alongside them to fund transportation

It’s also important to note that mobility fees are just one type of impact fee charged on new development in Pasco County. New construction is also subject to school impact fees, which help fund new schools and classroom capacity. And, park impact fees are used for land acquisition and creating new recreational facilities.

Together, transportation, school and park impact fees make up the bulk of the one-time charges paid when new homes and commercial projects are built. When combined, Pasco County’s total impact fee burden is often cited as among the highest in the region, reflecting both its rapid growth and the scale of infrastructure needed to support that growth

Why Are Mobility Fees Going Up?

Construction costs have skyrocketed in recent years. Roadway materials, labor and engineering costs have all increased — often sharply. Because of this, mobility fees have to be periodically updated to reflect the real cost of building roads today, instead of the costs from ten years ago.

Pasco County is allowed to update its mobility fee schedule every four years, and those updates are reviewed and recommended by the county’s Planning Commission, which looks at growth projections, construction costs and long-term transportation needs.

According to the county, Pasco is projected to add approximately 330,000 new residents over the next 20 to 25 years, requiring roughly 950 new lane miles of roads. Even with existing revenue sources, projected funding falls short of the need —which is why mobility fees matter.

How Much $ Are We Talking About?

Here’s a concrete example that helps put things in perspective:

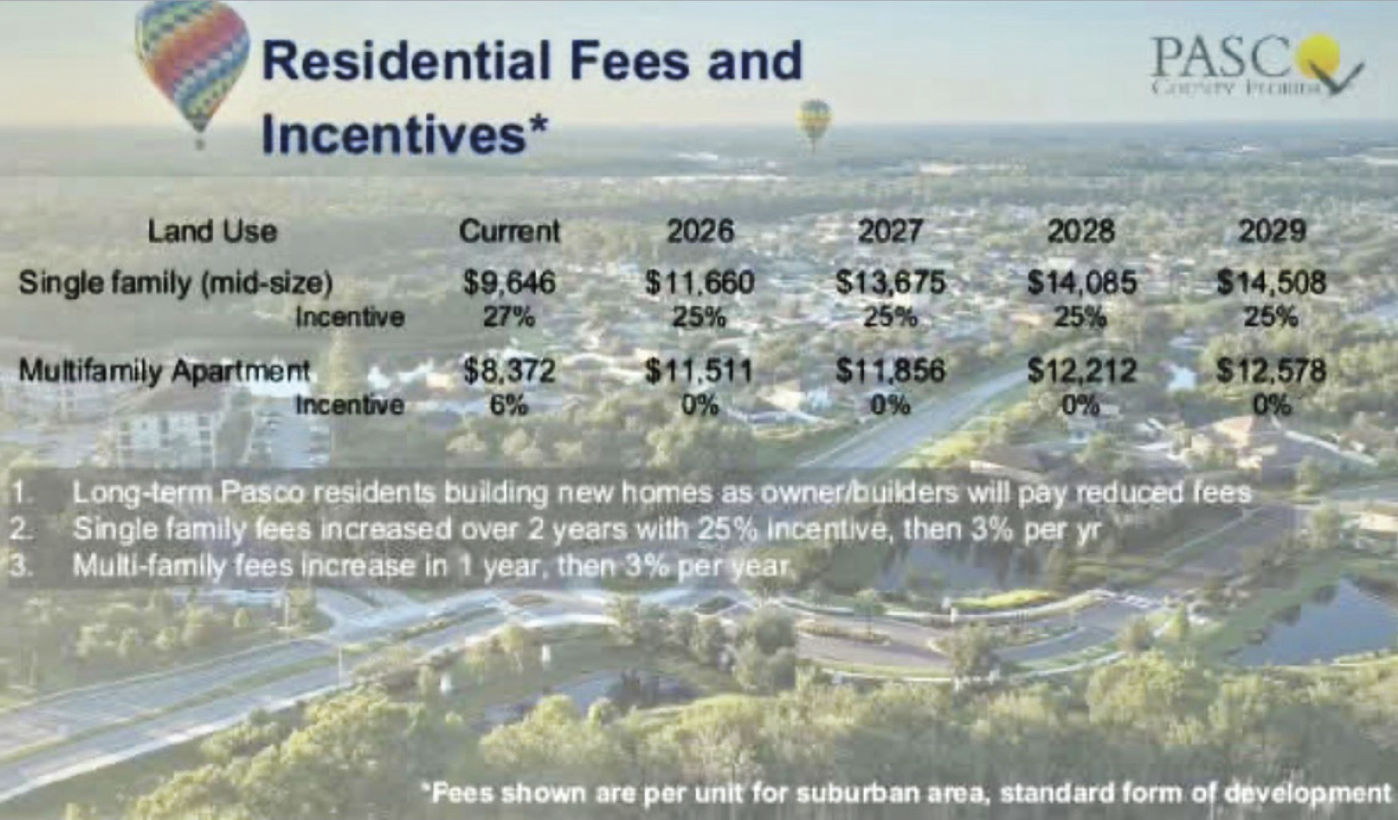

• A single-family home built in Pasco in 2026 will carry a one-time mobility fee of $11,660 that is paid by the builder.

• That money goes into county coffers for roads, sidewalks and transportation facilities.

The fee is paid once — not annually, and not by the homeowner directly at tax time. A common question is whether mobility and other impact fees on new homes are ultimately passed along to homebuyers. While opinions vary, there is little evidence this is happening in today’s market.

In many cases, new-construction homes in Pasco are priced equal to — or even less than —c comparable resale homes, which carry no such fees. Builders are also routinely offering substantial incentives, including covering large portions of closing costs and providing builder-financed mortgages with rates currently as low as 3.99% for 30 years.

Based on current pricing trends and transaction data, impact fees do not appear to be quietly “added back” elsewhere in the deal. As a result, despite these one-time development fees, new construction remains one of the most competitive and accessible options for buyers today.

Why Some Businesses Pay Nothing

This is where things get nuanced — and are often misunderstood by homeowners.

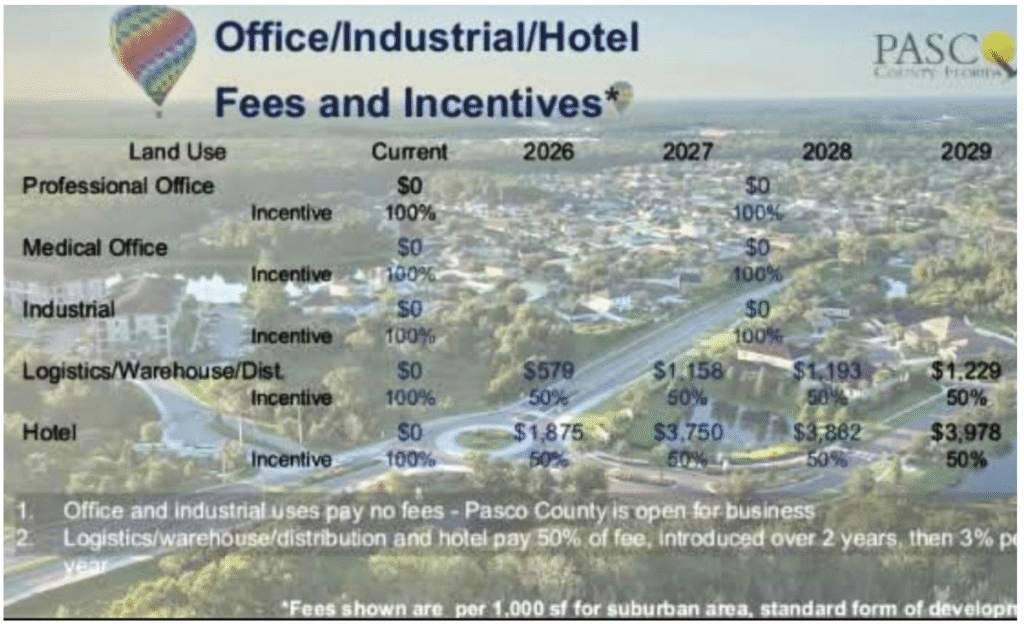

Pasco County doesn’t charge the same mobility fees to every type of development. Instead, it offers incentives to encourage certain kinds of businesses that bring higher-paying jobs and long-term economic growth, including medical & professional offices, industrial, logistics, warehouses, distribution centers and hotels

These uses currently receive a 100% incentive, meaning they pay $0 in mobility fees.

On the other hand, a fast-food restaurant with a drive-through might be charged a mobility fee of around $80,569, because it receives only a 25% incentive.

Why the difference? County officials have been clear about their goal: “Pasco is open for business,” especially for industries that diversify the tax base and bring higher-wage jobs to the county.

Who Covers The Rest Of The Cost?

This is where something called Tax Increment Financing (TIF) comes in.

TIF is often mentioned alongside mobility fees, but they work very differently:

• Mobility fees are one-time payments made upfront by developers.

• TIF uses future property tax growth to fund infrastructure over time.

Pasco County, “locks in” property tax values at a base year (2012 for unincorporated Pasco). As development happens and property values rise, the increase in tax revenue — the “increment” — is set aside.

About 33% of that increment is dedicated specifically to transportation improvements.

Those TIF funds are then used to “buy down” mobility fees for targeted developments like offices, industrial sites and hotels. In other words, the county — and its taxpayers — still funds the roads, but with future tax growth instead of charging those businesses up front for them.

Other Ways Infrastructure Is Built

Mobility fees aren’t the only way roads and infrastructure come online:

• Developers often build roads, turn lanes and/or sidewalks themselves as part of their residential or commercial projects and dedicate them to the county.

• If those improvements benefit more than just the residents of those developments, the developers can apply for mobility fee credits.

• Some communities (including many in Wesley Chapel) are built with Community Development Districts (CDDs) — quasi-governmental entities that maintain roads, sidewalks and landscaping within the developments themselves, rather than the county taking on that responsibility long-term.

This approach shifts some maintenance costs away from the county and onto the developments that directly benefit from them.

Why This Should Matter To You!

At the end of the day, mobility fees are about matching new growth with new infrastructure — and making sure existing residents aren’t left paying the full bill for new development.

Mobility fees are imperfect, complex and often controversial. But without them, Pasco County would face even larger funding gaps, even slower road improvements and even more pressure on general taxes.

As Pasco continues to grow, understanding how these fees work can help you better engage in conversations about development, transportation and the future of our community.

The growth is coming, no matter what. The real question is how we plan and pay for it.

And, most people sitting in traffic every day in Wesley Chapel believe that they are the ones paying for it — and that whatever money is coming in isn’t either not enough or not being spent fast enough to keep up — and no, they’re not wrong.

No comment yet, add your voice below!