As tax season heads into full swing, Patrick Murtha, the managing partner of the accounting firm of Murtha & Murtha, LLC, says that even if you’ve always done your taxes

When The Grove developer Mark Gold first started filling the many spaces at his KRATE Container Park, most of us realized that not all of the restaurants and retail shops

New coach. Some new players. Same old results. Wharton is headed back to the Class 6A boys basketball final four for the second straight season after dominating Charlotte 52-35 Friday

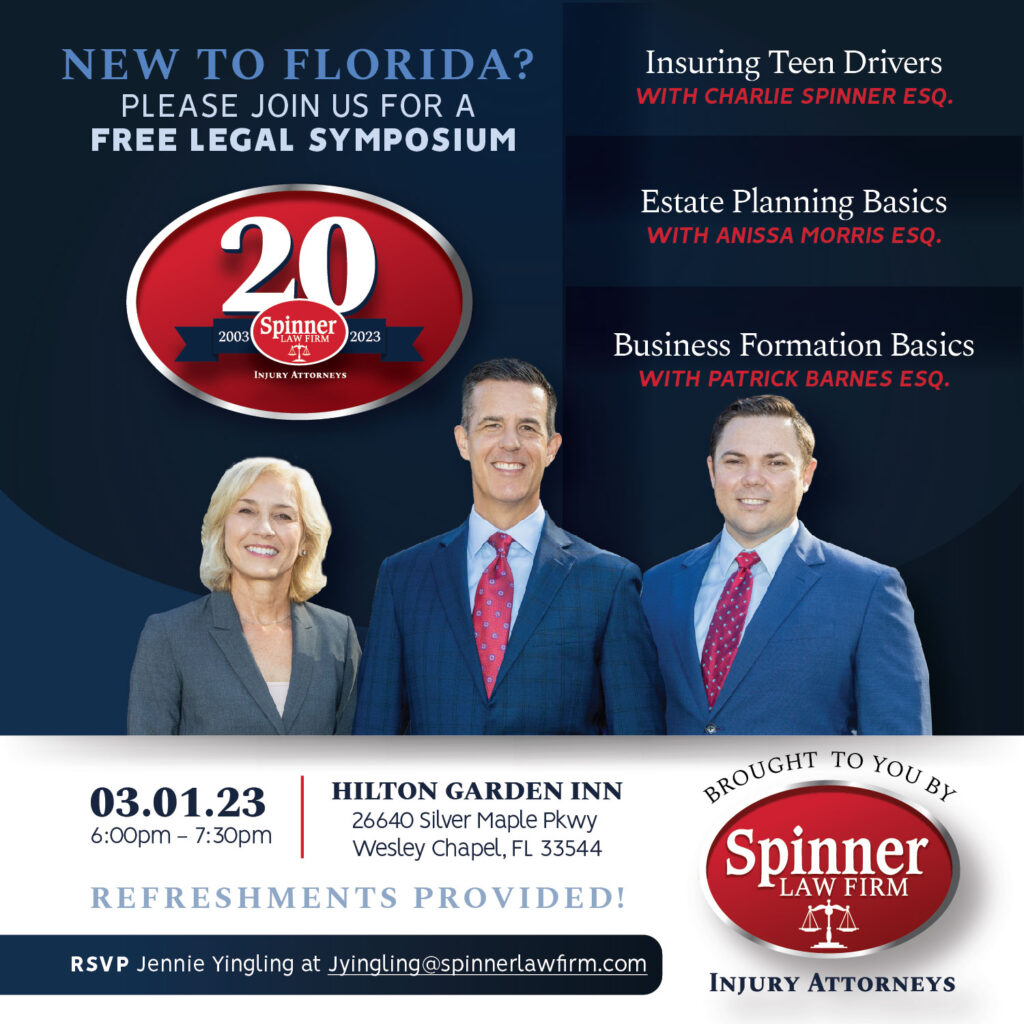

If you’re new to Florida, the attorneys of Spinner Law Firm are hosting a FREE legal symposium on Wednesday, March 1, 6 p.m.-7:30 p.m., at the Hilton Garden Inn Tampa-Wesley Chapel (26640 Silver Maple

Saddlebrook is becoming Sagabrook, as attempts to revitalize the former great resort continue to be mired in confusion and discontent. The latest efforts on Feb. 7 to push through an